Managed Accounts

1. Investment Planning:

Understanding you, your investment goals and the level of portfolio volatility you can tolerate given your time horizon and specific goals.

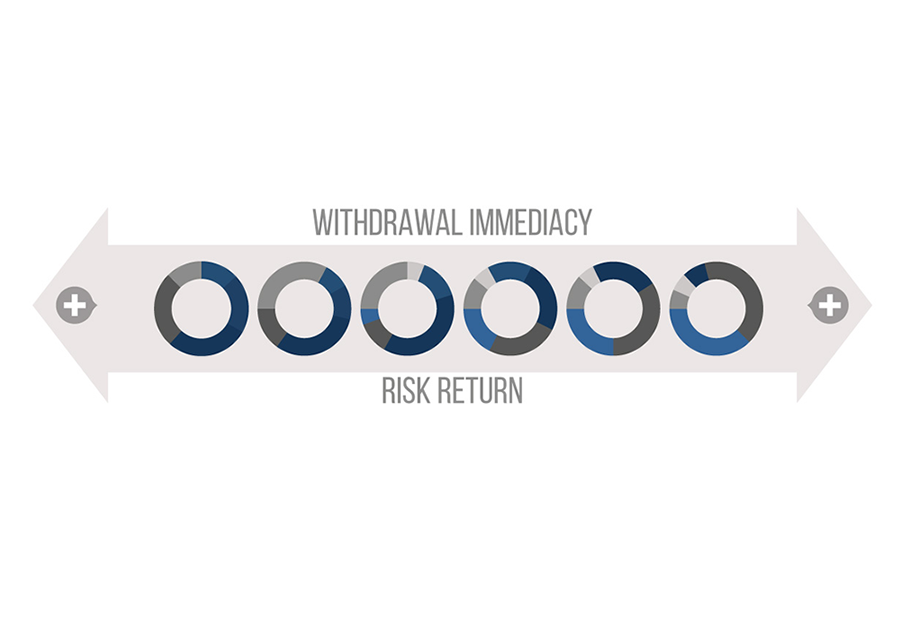

2. Asset Allocation:

We use the information from the planning stage and sophisticated construction techniques to target mix of assets that best fits your goals.

3. Manager Selection:

We screen and select the investment vehicles for your portfolio to maximize your performance.

4. Performance Reporting:

We provide you with regular reports to monitor your portfolio performance and adjust and adapt when required.

"To observe how people of prudence, discretion and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.”

The Prudent Rule